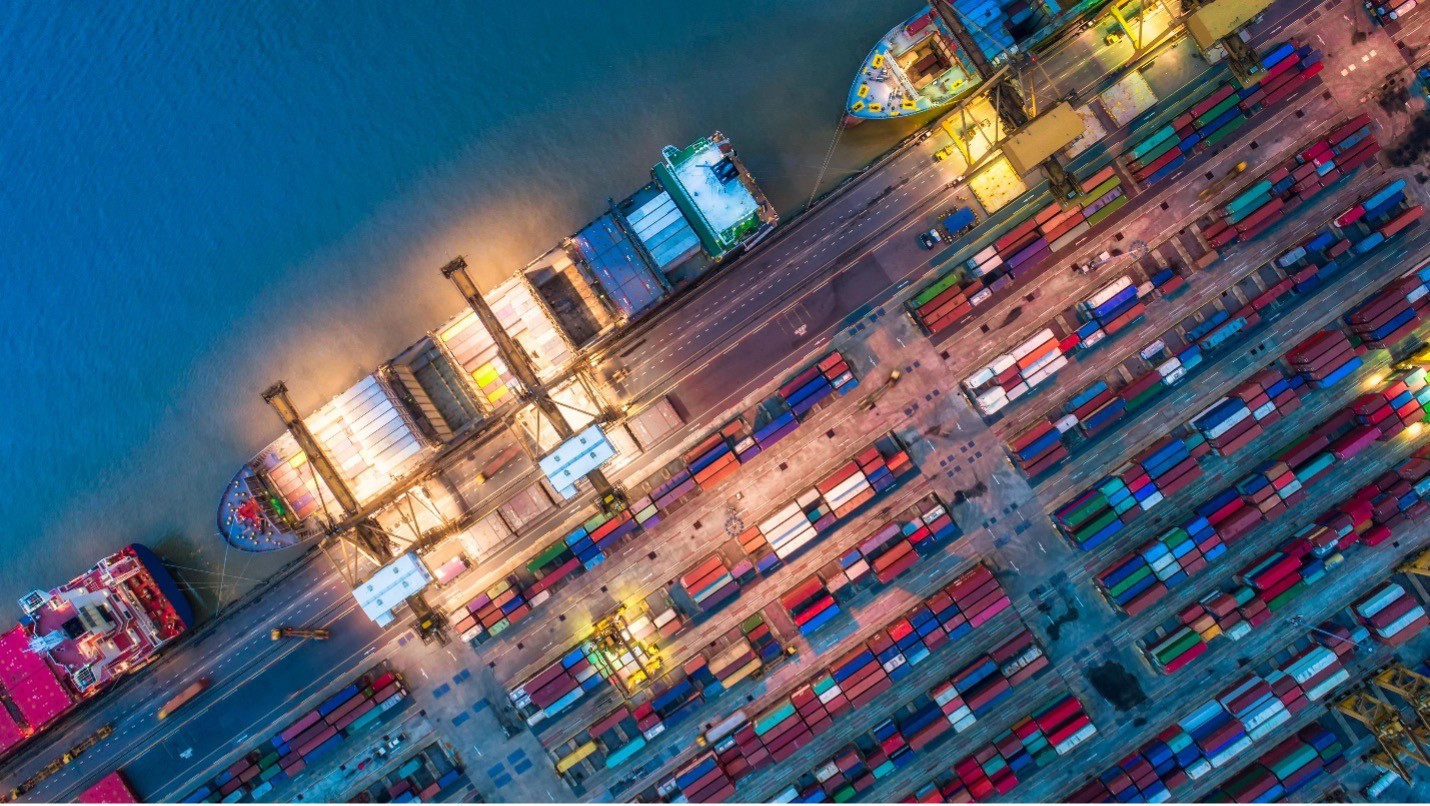

New Zealand’s supply chains are expected to be less disrupted but far more expensive in 2023, according to a new risk outlook by Massey University’s Supply Chain Risk Analytics Network.

Aotearoa New Zealand’s supply chains have been hit by numerous disruptions over the past couple of years due to the pandemic. Now experts and industry practitioners warn that while disruptions may be on the decline, 2023 will see significant costs and price escalations.

Massey University’s Supply Chain Risk Analytics Network (SCRAN) has just released their 2023 risk outlook for Aotearoa New Zealand and have identified a large number of issues that may influence supply chains in 2023.

Impacts of the global pandemic and geopolitical drivers are continuing to be felt in the supply chain. The 2023 supply chain risk outlook report summarises a review carried out by SCRAN in November 2022, with feedback received from 172 supply chain practitioners. The main areas of risk that the report identifies include high inventory levels, structural changes anticipated in supply chains, staffing, freight issues, but above all, inflation and the overall financial weaknesses in global markets.

As predicted in the 2022 SCRAN mid-year risk outlook, inventory levels have gone up to mitigate the typical disruptions experienced over the past two years. Now, however, demand is low and warehouses are full. This contributes to a range of inventory-related costs, including alternative storage needs when warehouses fill up, increased working capital and reduced cashflow.

Senior Lecturer in Supply Chain Management Dr Carel Bezuidenhout says supply chains have not recovered completely and businesses may continue a ‘just-in-case’ strategy going into 2023. “There is still a significant global bullwhip effect in many supply chains and waves of under and over corrections in inventory levels will continue well into 2023,” he says.

Similarly, due to the financial landscape that has resulted from the pandemic and the war on Ukraine, businesses are more likely to realign their focus on core products, core customers and reliable key suppliers.

Dr Bezuidenhout says this doesn’t always favour New Zealand supply chains. “Several practitioners state that during 2023 they expect revised business and supply chain strategies and refinements in internal systems, with marketing strategies and target regions also being reviewed. This exposes New Zealand supply chains to the possibility that, in some cases, Aotearoa may not form part of core business.”

The report states that increasing job pressures was the most frequently mentioned issue when supply chain practitioners were asked about their work in 2023. This continuous labour shortage impacts on all parts of the chain including ports, warehousing, transport, casual labourers and specialist personnel.

Several supply chain practitioners intend to revise terms with their freight partners in 2023 and new environmental regulations coming in January 2023 are expected to impact shipping schedules and efficiencies.

Dr Bezuidenhout says while we appear to be coming out of an unprecedented disruptive COVID period, with some exceptions in China, our supply chains still suffer with a little bit of long-COVID. “However, the new global financial realities are now the stronger forces at play. These forces are less likely to cause major disruptions to our supply chains, but high costs and slow markets will weigh us down significantly.”

Read the full report here.