For food and beverage exporters to China there are two significant events that occur in the mainland every November. One uses a modern digital platform to reach consumers and the other adopts a much more traditional approach to business buyers. The differences between the two say a lot about the complexities of designing a coherent channel strategy for the China mainland.

The first event to occur, on the 11th day of the 11th month, is the relatively new and deliberately contrived ‘Singles Day’. The brainchild of Alibaba’s online shopping channel ‘Tmall’, this has become 24 hours of shopping madness with sales direct to consumers amounting to billions of dollars by the end of the day.

Were they not verifiable you’d think that the numbers were mythical. In 2013 sales on Singles Day reached a heady US$6 billion. When a New Zealand delegation led by Minister Joyce visited Alibaba the following day the executive team seemed to be almost in a state of shock at the enormity of the preceding 24 hours.

In 2014 total sales hit a new record of US$9.3billion. To put it in perspective, that’s about 1.5 times the value of everything New Zealand sells to China in a year. At that level, and with the phenomenal year-on-year growth, Singles Day cannot be ignored by anyone building consumer brands in China.

New Zealand Focus engaged in Singles Day in 2014 with a comprehensive range of food and beverage products. We headlined with leading New Zealand brands such as Silver Fern Farms and Hansells, as well as our own Kiwifarm brand. Based on our previous experience through online and conventional channels we put together a mix of lamb cuts, abalone, assorted portions of beef, dairy products and kiwifruit juice, alongside our broader portfolio of honey, wine, beer and other premium consumer products.

The allure of being able to sell directly to such a massive and receptive consumer group has to be balanced carefully with the daunting logistics that come with it. Everything you put online has to be available in China at the time and capable of being dispatched to the consumer within seven days of the order being placed. This involves taking some very character-building guesses well ahead of the sale period.

For both NZ Focus and Tmall this was a learning experience. For Tmall the inclusion of food and beverage in any significant way for its Singles Day was relatively new, with consumer behavior less predictable than the non-food lines they had headlined in previous years. For NZ Focus the novelty was even more marked.

This gave rise to the sort of speculation that you can’t imagine hearing anywhere in New Zealand retail circles. Would we sell 10,000 lamb legs in 24 hours or would it be 20,000? Or, as someone less hinged than the rest of us suggested, perhaps it would be 40,000. Should we order in one tonne or two tonnes of abalone? How many thousand litres of kiwifruit juice should we make?

The heroes of the day, as it turned out, were the lamb legs (approximately 12,000), the abalone (just under a tonne), beef (6.5 tonnes of assorted cuts) and the 24,000 litres of kiwifruit juice.

For online sellers, Singles Day is as much about brand building and awareness as it is anything else. Products are required to carry significant discounts and so margins are squeezed to within inches of their lives. Few people make much money on the day itself but the reach to the consumer base and the permanent record of sales and satisfaction levels that Tmall carries alongside every product on the site are as effective as any advertisement in encouraging future sales.

Traditional with a twist

No sooner had Singles Day been and gone than the annual Food & Hotel China (FHC) trade show came alive in Shanghai. Where Tmall is a new and burgeoning medium for selling, FHC is redolent of any trade show you have ever attended anywhere in the world – with a Chinese twist.

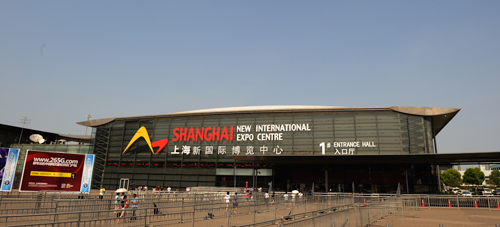

Trade shows are a very important part of business development throughout Asia and every major city is busy outdoing everyone else with the enormity of their exhibition facilities. Shanghai is no different and the Shanghai New International Expo Centre (SNIEC) site in Pudong is simultaneously a mess of construction and deconstruction, confounding traffic flows and barely orderly queues of exhibitors and visitors fighting their way into and out of the grounds.

If you’re serious about selling to the food service sector in China at some stage or another you will end up at FHC and/or a raft of other category-specific shows around the country.

These are important because they are unique opportunities to meet people who can help your business in parts of China that you could not possibly hope to reach on your own. Bear in mind that no single company has a truly national reach in China, not even the huge local distributors. Many will tell you they do but none of them are telling the truth.

For those familiar with Anuga or SIAL, or any of the other major European food shows, FHC comes as something of a surprise. For starters it’s much smaller than you would expect. Where Anuga received 155,000 visitors in 2013, FHC had 34,000. People from 98 countries visit Anuga whereas the overwhelming number that visit FHC are from China itself.

There is very little of the glitz and glamour that you find in Anuga or the over-the-top stands of the American brewers at the National Restaurant Show in Chicago. Many of the stands at FHC are almost desultory and the people who trawl through them are a very mixed bunch to say the least. But the value of trade shows lies in the nuggets you pick up along the way and there are certainly those at FHC. It’s almost impossible to get to these vital trade contacts any other way.

Working the traditional and non-traditional channels in China is an art form and one that requires close and constant attention. There are many more than Tmall and FHC – far more than any one company could sensibly manage.

The only way to know for sure which works is to be an active part of them – there simply is no substitute if you are taking China seriously.

Rod MacKenzie is executive director of NZFocus (NZ) Limited and a former regional director, Greater China, for NZTE.